Life can be wonderful. But it can also get complicated when unexpected things happen. Protecting your loan payments against the unexpected such as a disability or covered life event [including dismemberment and terminal illness] could help you protect more than your finances. It could help lighten the burden for the people you care about. Insure your loan payments today so you can worry a little less about tomorrow.

There’s no way to predict an injury, illness or other unexpected life event. You can take steps to protect your family if the unforeseen happens. Credit disability and credit life insurance may help reduce or pay off your covered loan or make your monthly loan payment, up to the policy maximum, in the event of a covered life event, injury, illness or death.

You decide which payments you want to protect and the monthly premium may be added to your loan. Coverage is designed to fit your lifestyle, it is totally voluntary, and it won’t affect your loan approval. It’s simple to apply. You can sign up for credit insurance at your loan closing, or anytime you’d like. Visit any branch or call our Contact Center at 800.336.6309 to learn more.

Disclosure: Credit Life and Credit Disability Insurance, underwritten by CMFG Life Insurance Company (Home Office: Waverly, IA), is optional to purchase and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the Group Policy for a full explanation of the terms. Base Form Numbers: CI-MP-POL, CI-SP-POL, B3a-830-0996, B3a-800-0695, B3a-800-0288, CI-MP-CE-POL, CI-MP-OE-CC-POL, CI-MP-OE-POL,

B3a-800-0992.

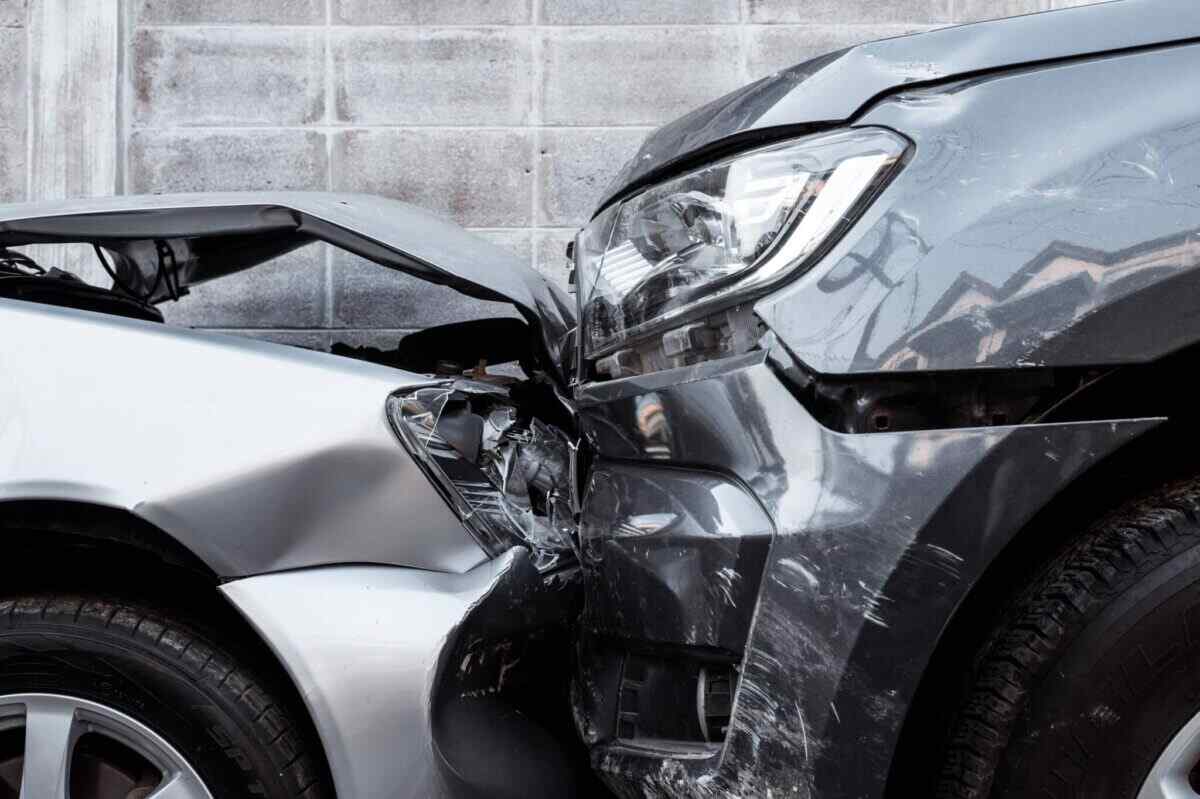

Guaranteed Asset Protection (GAP) is a great way to protect your finances if the value of your vehicle is less than the amount of your car loan. A good rule of thumb is to assume your new vehicle will depreciate on average 20% the first year you own it, half of which occurs the minute you drive it off the lot.* This leaves a gap between what you owe on your loan and the value of your vehicle if it’s deemed a total loss due to an accident or theft. Our GAP program can help fill the gap between what your vehicle insurance will pay and what you owe on your loan. Plus, it helps you get into your next vehicle by reducing your loan at the credit union by $1,000 or more. Contact us today to learn more about adding GAP Plus to your vehicle loan so you can worry less about tomorrow.

Visit any branch or call our Contact Center at 800.336.6309 to learn

*Car Depreciation – 5 Things to Consider, CARFAX, May 18, 2017Your purchase of MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP), is optional and will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.GAP purchased from state chartered credit unions in FL, GA, IA, RI, UT, VT, and WI, may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee. GAP purchased from state chartered credit unions in CO, MO, or SC may be canceled at any time during the loan and receive a refund of the unearned fee. GAP purchased from state chartered credit unions in IN may be with or without a refund provision. If the credit union offers a refund provision, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP-2178988.1-0718-0820 © CUNA Mutual Group, 2018. All Rights Reserved.

As vehicles get older and miles add up, the likelihood for repairs increases. Mechanical Repair Coverage can help you limit out-of-pocket, costs for covered breakdowns. Download additional details about MRC and available plans.

Visit any branch or call our Contact Center at 800.336.6309 to learn more.

Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. in all states except CA, where coverage is offered as insurance by Virginia Surety Company, Inc., in WA, where coverage is provided by National Product Care Company and administered by Consumer Program Administrators, Inc., in FL, LA and OK, where coverage is provided and administered by Automotive Warranty Services of Florida, Inc. (Florida License #60023 and Oklahoma License #44198051), all located at 175 West Jackson Blvd., Chicago Illinois 60604, 800.752.6265. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc. In CA, where Mechanical Repair Coverage is offered as insurance (form MBIP 08/16), it is underwritten by Virginia Surety Company, Inc. Coverage varies by state. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions of this voluntary product. MRC-2341946.1-1218-0121 © CUNA Mutual Group 2018

By clicking “Accept all,” you agree Greenville Federal Credit Union can store cookies on your device and disclose information in accordance with our Cookie Policy.

Please enter your information below to access your download.